A short term trade looks to be developing in Macau. We’ve been falling since May and we seem to have found a plateau, a short term bottom. We may see a brief bounce from here but it is unlikely to last for more than a few months at most. Major anticipated earnings are on tap this week for Las Vegas Sands and Wynn, and Melco in early February. There may be a decent opportunity for short term traders here in these casino stocks, but longs should be prepared to cap profits at a predetermined hard target, get out quickly, and move on.

There are several reasons why we could see a tradable pop higher in Macau stocks in the short term. First, there are decent short term technicals. Volatility in the gaming sector has fallen significantly since October. The BJK gaming ETF has been pinging between support and resistance for nearly 4 months now, with strong resistance at $37 about to be tested for the fourth time. The first resistance zone at $33 was easily broken through and that led to a quick 10% rally. Break through strong resistance at $37 and the skies are clear until at least $38, with a decent chance we could see $40 if earnings come in above expectations. That’s a total potential 10% rally further up. Volume has leveled off since the beginning of the year so it seems that traders are either already positioned for earnings or are waiting for them to be released to make their moves. I would guess that the smart money is already in, waiting for earnings to bump Macau higher and sell the news. Dumb money is probably waiting for good news to buy.

The 50-day moving average was broken through to the upside on January 7th and just started turning up again. RSI has held above 50 since the beginning of the year, sign of a possible short term trend change. On the weekly charts, RSI is now approaching 50 for the first time since Macau topped in May. We are also up 4 weeks in a row for the first time since September 2017. BJK has now 18% from lows, which means that if we move 2% higher from here, we’ll start seeing those superficial “Macau is Back in a Bull Market!” headlines, sucking in more retail money. Basically, most of the major technical indicators are showing that a big short term move could be imminent, and earnings will likely be the trigger.

Besides technicals favoring a bump higher, we have the added plus of expectations already being pretty low. Sanford C. Bernstein came out with a forecast of an 8-12% dip in gross gaming revenue this month. Morningstar Asia came out with a similar forecast calling for a contraction this year. We also have another nominal face-saving crackdown out of Reuters on a $4.42 billion illicit ATM ring where a “criminal gang” was caught for the horrible crime of bringing cash machines over to Macau from the mainland so gamblers could, you know, gamble. News like this dampens sentiment and brings expectations lower than otherwise without actually making a dent in anything, any more than a drug bust makes a dent in the illegal drug industry. All it does is subsidize the lawbreakers that haven’t been caught yet, probably because they can afford higher bribes, and inch up their profit margins. Keep in mind the $4.42 billion isn’t subtracted from Macau GGR. It’s subtracted from the books of the groups that operated the ATMs before it’s even counted as Macau GGR.

So why is this probably not a long term bottom? Chinese economic data is already weak. We have the headlines of China GDP expanding at the slowest pace in 28 years. While GDP by itself is a pretty meaningless number, there are other confirmatory signals that China is slowing down. Defaults on Chinese corporate bonds for example rose to a record high last year according to Fitch. Meaning, higher than the 2007-2008 crash. 45 corporate entities defaulted on 117 bond issuances for a total of $16.3 billion in lost debt. More worrisome still is that the defaults were in the capital goods sectors; construction and engineering, industrial conglomerates, utilities and highways. That’s the beginning signs of the end of a major boom.

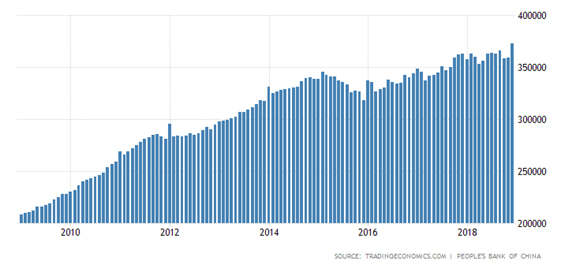

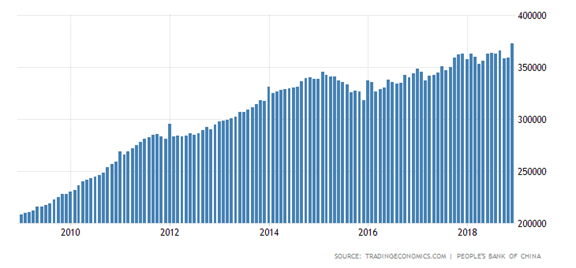

We also have what looks like a visible slowdown in Macau M2 money supply.

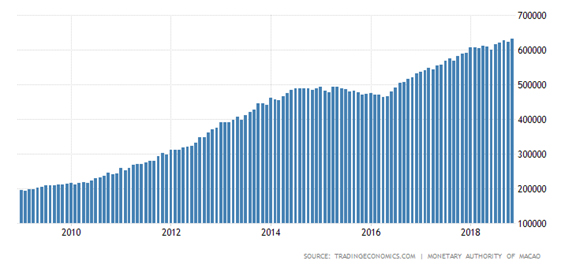

The plateau from late 2014 to early 2016 is obvious, and it the rate of increase has visibly slowed since the beginning of 2018. M2 growth in mainland China is also slowing. Below, a graph of the balance sheet of the People’s bank of China, shows why:

Until the spurt higher last month, the PBOC’s balance sheet has stayed static since late 2017. Chinese money printing is on hiatus. Plus, if you take a closer look at this chart, you may notice that these one-month wonders in PBOC printing bursts have happened before, at the beginning of 2012, 2014, and 2016. This could just the one month spurt that will be quickly reversed next month. We’ll have to see. Even if not though, it is still clear that direct PBOC monetary expansion has slowed dramatically since 2015.

Finally, beware of a “trade agreement” between China and the US. While news of something like this will probably push Macau stocks higher in the short term, it will almost certainly be a bad deal fundamentally. There is talk of China offering to buy $1 trillion more in US products with the aim of ending its trade surplus with the US some time next decade. This is loony, because if the Chinese wanted to buy $1 trillion more of US products, they’d already be doing it. The fact that they’re not means they are either getting them cheaper somewhere else, or they just don’t want them. Xi Jinping doesn’t import US products. Private Chinese companies do. Forcing private companies to import more US products than they want will just go against (relative) free market choices in China and mess up the Chinese economy that much more. It’ll also, by the way, make funding the enormous federal budget deficit much harder, a deficit that is currently funded by China’s dollar trade surplus, sent back to Washington in exchange for US Treasuries.